Imagine this: your smartphone, electric car, and even your country’s missile system all depend on obscure, hard-to-pronounce minerals buried deep beneath the Earth’s surface. These are rare earth elements (REEs), and they’ve quietly become the most critical asset in the US–China trade and tech rivalry.

China currently controls over 70% of global rare earth production and an even larger share of the processing industry. As a result, these materials have become the silent chess pieces in the great geopolitical game of the 21st century.

What Are Rare Earths, and Why Do They Matter?

Rare earths aren’t actually “rare”, they’re just difficult to mine and refine. There are 17 of them, used in everything from:

- Mobile phones & touch screens

- Electric vehicle batteries

- Wind turbines & solar panels

- Military-grade missiles, radars, and aircraft engines

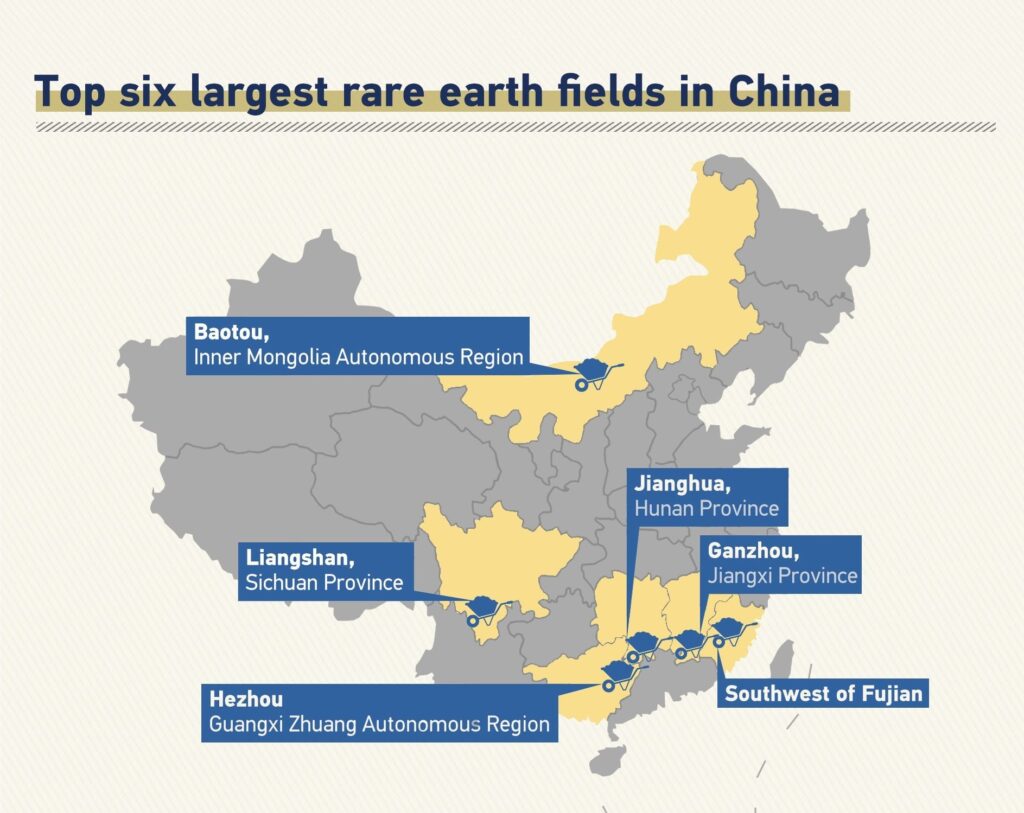

China’s Rare Earth Monopoly

Since the 1990s, China has invested aggressively in strategic earth mining and processing. Today:

- It refines over 85% of the world’s REEs

- Owns critical processing plants in Africa and Southeast Asia

- Holds strategic reserves to influence global prices

Furthermore, China has even threatened export bans in past trade disputes, turning these minerals into economic weapons.

In 2024, when the US announced AI chip restrictions, China responded by curbing exports of gallium and germanium, both of these metals are crucial to semiconductors.

How the US Is Responding?

The US Department of Defense has now classified rare earths as a “national security priority.” To reduce reliance on China:

- The US is reviving its only rare earth mine in Mountain Pass, California.

- It’s investing in processing plants with Australia and the EU.

- CHIPS Act includes funding for critical mineral supply chains.

However, experts say it will take years to break free of Chinese dominance.

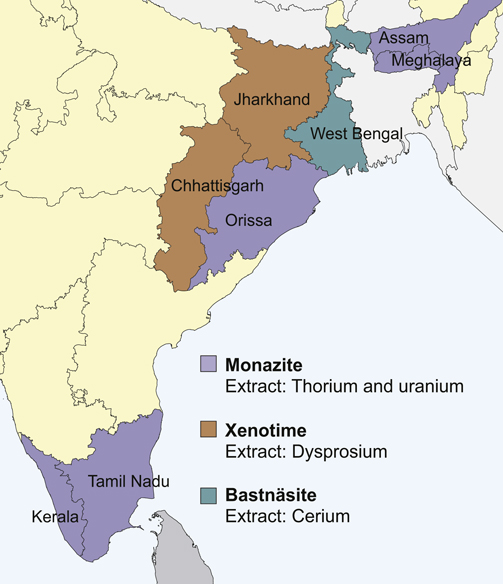

The Global Scramble: India, Australia, and Beyond

Meanwhile, countries like India, Australia, Japan, and even the EU are racing to diversify their essential earth sources.

- India has large REE deposits in Tamil Nadu, Orissa, Chhattisgarh, Jharkhand, West Bengal and Northeast. It recently signed deals with Australia for tech transfer.

- Similarly, Australia is home to Lynas Corporation, the world’s largest rare earth company outside China.

Tech Cold War

The rare earth war may sound like a distant diplomatic issue, but its ripple effects hit your everyday life:

- Prices of smartphones, EVs, and green tech could surge.

- Clean energy transitions may slow down.

- Military standoffs could sharpen if one side blocks supply chains.

Ultimately, it’s a global tech cold war, fought not with missiles but with minerals.

While most people worry about oil and data, the next global power struggle may be decided by a pile of dusty gray minerals. Rare earths may be buried underground, but in the US–China trade war, they’re right at the surface of the global power struggle.

For more such informative articles stay tuned at The World Times.

2 thoughts on “Rare Earth Crisis Fuels Global Tensions”