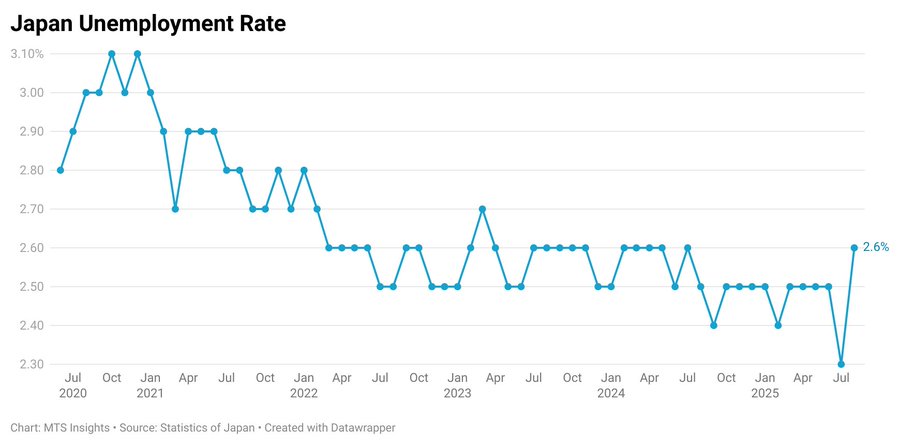

Japan’s unemployment rate increased to 2.6% in August, the highest level since mid-2023, highlighting challenges in the labor market and broader economy.

Key Details of Japan’s unemployment

Japan’s unemployment rate climbed to its highest level in more than a year in August. This indicates a modest cooling of the labor market amid growing speculation about a potential Bank of Japan rate hike.

According to the Internal Affairs Ministry’s report on Friday, the jobless rate rose to 2.6% in August from 2.3% in July, exceeding economists’ median forecast of 2.4%. Meanwhile, data from the Labor Ministry showed the job-to-applicant ratio slipped to 1.20 from 1.22—meaning there were 120 job openings for every 100 job seekers, the lowest level since 2022.

The number of unemployed increased by 150 thousand to a 13-month peak of 1.79 million. At the same time, employment fell 210 thousand to a four-month low of 68.10 million. In a parallel move, the labor force edged down 40 thousand to 69.89 million. Meanwhile, the number of people outside the labor force was down by 20 thousand to 39.70 million. On a non-seasonally adjusted basis, the labor force participation rate went up to 64.0% from 63.6% a year earlier. Meanwhile, the jobs-to-applicants ratio eased to 1.20, the lowest level since January 2022.

Drivers of Japan’s unemployment

Japan’s recent rise in unemployment likely stems from sluggish domestic consumption and weaker exports. This is reflected in weakness in the manufacturing and retail sectors, and hiring freezes in tech. Structural factors like an aging population and labor shortages are accelerating automation and the growth of precarious work. One-off events such as recent extreme weather or policy shifts could also influence the August figures. Specifics, however, are not readily available without that data.

A lack of consumer spending can lead to reduced demand for goods and services. This often causes companies to slow down hiring or even reduce their workforce. A downturn in global demand for Japanese products can directly impact manufacturing and export-oriented sectors, leading to fewer jobs. This sector is sensitive to both domestic and global demand. A general slowdown can lead to reduced production and job cuts.

While inbound tourism can be a strong driver for Japan, its reliance on international arrivals makes it vulnerable to global events and seasonal fluctuations. This vulnerability impacts related jobs in hospitality and retail. There are periods of high demand for certain roles, particularly in retail and hospitality. This demand can mask underlying weakness when these seasonal patterns shift.

Sectors Reporting Weakness

Recent data shows some segments of the Japanese economy struggling with employment. This suggests unevenness in the labor market’s recovery and distribution of work.

- Service sector: Following the COVID-19 pandemic, sectors that saw significant declines in employment included the accommodations, eating and drinking services, and amusement services industries. The Bank of Japan also noted continued weakness in the employment situation of the overall service sector as recently as 2020.

- Retail: The retail industry was hit hard during the pandemic, especially among non-regular employees. Data from 2022 showed that retail workers, particularly women, reported experiencing high emotional burdens, indicating job-related stress and instability.

- Manufacturing: While some factory activity has shown signs of a rebound, demand for goods has been subdued. This is true in both domestic and overseas markets. In December 2023, some firms reported that weakness in new orders was tied to the semiconductor market.

- Self-employed and small businesses: A long-term downward trend in the labor share has been a contributing factor to the overall economic challenges since the 1990s. This trend has been driven by a decrease in the income of the self-employed and executives of small and medium-sized enterprises (SMEs).

Future of jobs in Japan

A declining and aging population is driving a severe labor shortage that characterizes the future of jobs in Japan. To address this, the government is relaxing immigration laws, and companies are aggressively recruiting foreign and domestic talent. Automation and AI are advancing rapidly, altering the nature of jobs and increasing the need for upskilling.

Japan has a high employment rate and a shrinking working-age population, leading to a critical labor shortage across multiple sectors. This has put upward pressure on wages and created numerous job openings. The government is actively implementing policies to increase the participation of women, seniors, and immigrants in the workforce. New visa categories are making it easier for foreigners to work in Japan. One example is the Specified Skilled Worker (SSW) visa. Traditional hiring based on lifelong loyalty is becoming less common. Companies are now more focused on hiring for specific skills and proven expertise.

In conclusion, Japan’s rising unemployment rate and declining job-to-applicant ratio suggest that the labor market is gradually losing momentum after a period of tight conditions. While the overall job situation remains relatively stable, the slowdown may ease pressure on the Bank of Japan to raise interest rates aggressively, as policymakers balance inflation concerns with signs of cooling employment demand.

For more such informative articles stay tuned at The World Times.