International Monetary Fund (IMF) Managing Director Kristalina Georgieva has urged the United States and China to de-escalate rising trade and technology tensions, warning that a continued standoff could derail fragile global growth. Speaking at the IMF’s Annual Steering Committee meeting in Washington, Georgieva cautioned about disruptions in key sectors like critical minerals and technology supply chains. She warned that these could “materially impact” the global economy.

Global Growth on Edge

The IMF’s October 2025 World Economic Outlook projects global growth to slow from 3.3 percent in 2024 to 3.2 percent in 2025 and 3.1 percent in 2026. Advanced economies are expected to grow around 1.5 percent. Emerging market and developing economies are expected to expand just above 4 percent. Although, this is slightly higher than earlier forecasts but still below pre-pandemic averages.

Global headline inflation is expected to decline further but remain above target in some countries. Risks to the outlook are tilted to the downside. Moreover, prolonged uncertainty and escalation of protectionist measures may further hinder growth.

Fiscal vulnerabilities and financial market fragilities may interact with rising borrowing costs and increased rollover risks for sovereigns. In addition, an abrupt repricing of tech stocks could threaten macro-financial stability, according to IMF.

Trade and Tech Rivalry Intensifies

At the heart of the IMF chief’s warning lies the deepening U.S.–China rivalry over trade, semiconductors, and access to rare-earth minerals — crucial inputs for batteries, AI systems, and defense technology.

The United States has expanded export controls on Chinese tech firms, citing national security concerns. In response, Beijing has retaliated with restrictions on the export of gallium and germanium — key components in electronics manufacturing.

Several Asian economies caught in the supply-chain crossfire, including Vietnam, Malaysia, and South Korea, are seeing rising volatility in industrial output.

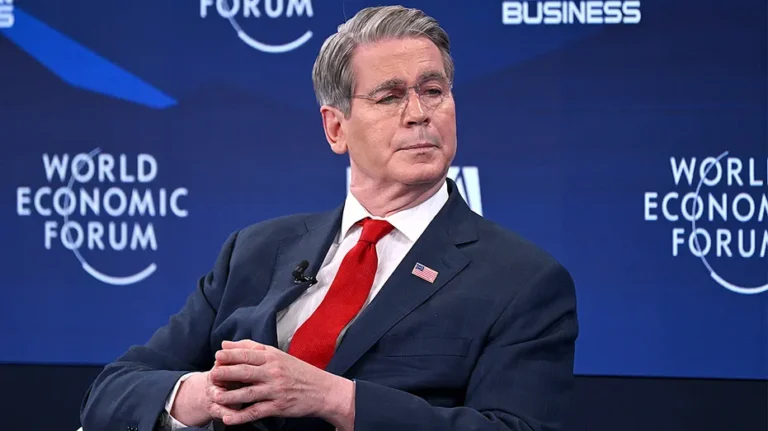

China on Thursday accused the U.S. of stoking panic over its rare earth controls. Furthermore, it said Treasury Secretary Scott Bessent had made “grossly distorted” remarks about a top Chinese trade negotiator, rejecting a White House call to roll back the curbs.

Systemic Risks: From AI to Fiscal Fragility

Systemic risks are large-scale harms to the financial system arising from the interaction of Artificial Intelligence (AI) and economic fragilities. These fragilities include market volatility, third-party dependencies, and the potential for AI-driven fraud or misinformation. While AI offers benefits like efficiency, its rapid adoption could lead to concentrated risks in areas like AI models. Consequently, this can create financial fragility that, when combined with economic shocks, may trigger systemic crises.

The rapid adoption of AI in finance is increasing systemic vulnerabilities. The widespread use of similar AI models can synchronize market behavior, amplifying volatility and making the system more fragile. Dependence on a few third-party providers for hardware, cloud services, and foundational models adds concentration risks. Additionally, heightened cybersecurity risks increase exposure and amplify vulnerabilities in the system.

AI also introduces threats such as misinformation, model misalignment, and inadequate oversight. Poorly validated models can produce unethical or unstable outcomes, while AI-driven disinformation could trigger crises like flash crashes or bank runs. Thus, these risks highlight how technological innovation can deepen existing economic fragilities rather than reduce them.

To mitigate these challenges, regulators and institutions must adapt frameworks to oversee AI-driven systems more effectively. Strengthening cybersecurity, ensuring data integrity, promoting diversity in AI models, and enhancing monitoring and governance are essential steps to prevent AI from becoming a new source of global financial instability.

MF’s Message: Don’t Let Rivalry Replace Reason

Georgieva urged both powers to prioritize “economic pragmatism over political confrontation” and warned that retaliatory trade measures could trigger a “cascade of counter-restrictions” that would spill across markets.

“No country wins a race to the bottom,” she said, emphasizing that the world needs “responsible economic leadership” from its two largest economies.

The IMF also recommended a renewed multilateral framework to address trade disputes and digital-economy regulation, highlighting that a cooperative approach would benefit developing economies most vulnerable to global price shocks.

A Test for Global Leadership

The IMF’s warning underscores a broader truth — that economic interdependence is both a source of strength and vulnerability.

As nations grapple with energy transitions, digitalization, and post-pandemic recovery, the IMF is calling for a “recommitment to cooperation” before economic nationalism undermines decades of progress.

“The world cannot afford another Cold War — this time in trade and technology,” Georgieva concluded.

For more such informative article stay tuned at The World Times.