The International Monetary Fund has issued a wake-up call to governments worldwide — spend smarter or risk economic stagnation. As global debt swells and fiscal inefficiencies multiply, the IMF warns that careless public spending is eroding growth potential and threatening long-term stability, urging leaders to reform how every public dollar is used.

IMF Rings the Alarm on Wasteful Expenditure

The International Monetary Fund (IMF) has cautioned that financial risks are intensifying due to rising debt levels, expanding tariffs, and the swift growth of nonbank financial institutions (NBFIs).

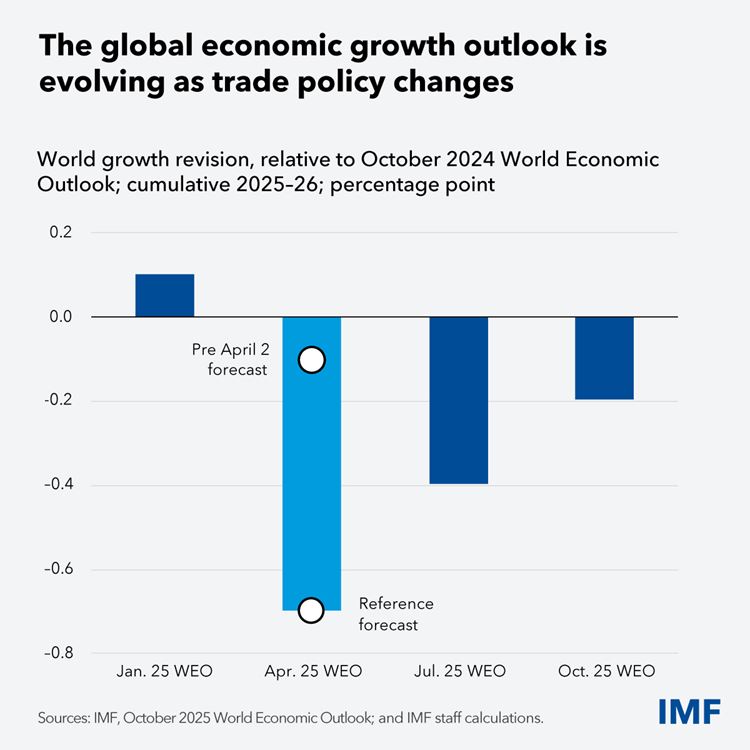

In its Global Financial Stability Report, the IMF warned that investors are showing concerning “complacency.” Rising trade tensions, fiscal gaps, and geopolitical uncertainties continue to reshape global financial conditions. Earlier, the IMF projected a slowdown in global economic growth, with output expected to decline from 3.3% in 2024 to 3.2% in 2025 and 3.1% in 2026. The Fund attributed this moderation to higher U.S. tariffs, which are weighing on global trade and investment.

Mounting Debt, Shrinking Efficiency

According to the IMF, many nations are facing ballooning public debt while failing to achieve proportional social or economic benefits. The Fund noted that excessive subsidies, corruption, and misallocated funds are draining resources that could otherwise boost productivity and equity.

Higher U.S. tariffs are particularly challenging, curbing external demand for export-led economies and creating a climate of uncertainty for investors. The IMF warns that markets may be underestimating risks from rising trade protectionism and growing debt levels. Key economies, including India, could face heightened financial vulnerabilities.

Moreover, the IMF noted that debt burdens are increasingly shifting toward governments, as widening fiscal deficits put added strain on sovereign bond markets. The report cautioned that “a sudden spike in yields — possibly sparked by doubts over debt sustainability — could weaken banks’ balance sheets and intensify stress on open-ended funds.”

Call for Fiscal Reforms and Transparency

The IMF urged policymakers to prioritize spending reviews, strengthen budget oversight, and adopt transparent systems to track outcomes. It recommended redirecting funds toward high-impact sectors like health, education, and infrastructure to ensure sustainable growth.

Governments worldwide could achieve substantial economic gains by improving the efficiency of their public spending, according to the International Monetary Fund’s latest Fiscal Monitor. The report estimates that adopting global best practices in public spending could raise output by about one-third on average. Emerging and developing economies could see growth rise up to 11%, while advanced nations may gain around 4% over the long term.

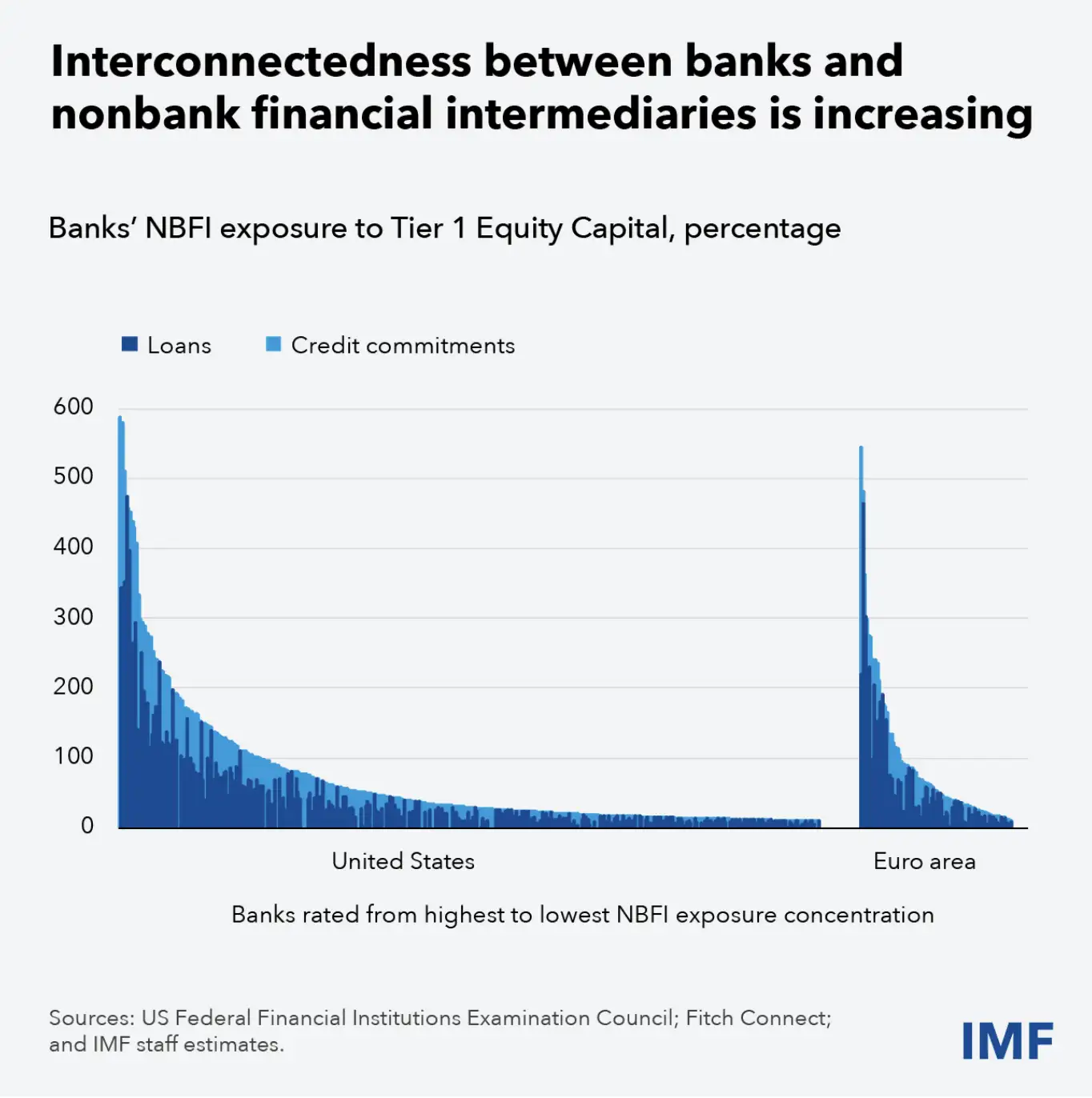

The IMF has drawn attention to the growing influence of nonbank financial intermediaries (NBFIs) — such as insurance firms, pension funds, investment funds, and private credit lenders — warning that their deepening ties with traditional banks could heighten systemic vulnerabilities.

Tobias Adrian, IMF Financial Counsellor, noted that “stress testing shows that the vulnerabilities of these nonbank intermediaries can quickly spill over into the core banking system, amplifying shocks and complicating crisis management.”

Today, nonbanks control nearly half of global financial assets and account for around 50% of daily foreign exchange turnover — more than double their share from 25 years ago. While they play a vital role in channeling credit and liquidity, their rapid expansion has increased risk-taking and interdependence across the financial system. The IMF’s stress tests reveal that if nonbanks were hit by credit downgrades or drew heavily on bank credit lines, U.S. and European banks could experience steep declines in capital ratios, underscoring how swiftly risks can spread through global markets.

Balancing Growth with Responsibility

The Fund’s statement comes at a time when global economies are struggling with post-pandemic recovery, inflation, and geopolitical tensions. Experts urge governments to balance stimulus with responsible spending to prevent fiscal crises and ensure sustainable growth in the next decade.

As nations juggle growth ambitions with fiscal realities, the IMF’s message is clear — efficiency is the new currency of stability. Governments that spend wisely, not just generously, will build stronger and more resilient economies. Smart fiscal choices today pave the way for fairer growth tomorrow.

For more such informative articles stay tuned at The World Times.