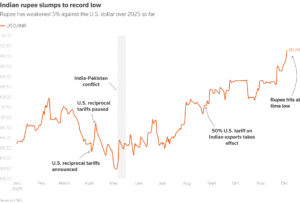

The Indian rupee fell below the “psychologically significant” ₹90 per US dollar mark on Wednesday. The move marks a continuation of the currency’s eight-month decline and leaves the rupee among Asia’s weakest performers this year—down roughly 5% year-to-date.

Analysts and traders pointed to several intersecting pressures for the dip. This includes large net equity withdrawals by foreign portfolio investors, surging import bills (notably for gold and crude), and the disruption in dollar inflows due to weakening external financing.

Market mechanics and hedging activity have amplified the slide. Forward premiums (the extra cost to hedge rupee exposure) have risen sharply, with the one-month forward premium reaching levels last seen several months ago as importers and corporates increase dollar hedging. That added demand for dollars in the forward market has reinforced weakness.

A major, near-term catalyst for the currency’s deterioration has been the stalling of trade negotiations with the United States and the threat of punitive tariffs on Indian goods. Traders say these tariffs have dented export revenue and investor confidence, prompting some foreign funds to reduce exposure to Indian assets. Barclays and other strategists have flagged that, absent a resolution, the rupee could remain under pressure into 2026.

What the Rupee falling means for ordinary people

Economists say that a weaker rupee will have direct consequences for household budgets, import-dependent businesses and financial markets. As it dips, anything linked to the US dollar becomes expensive. That includes:

Fuel and Cooking Gas (LPG): India imports over 80% of its crude. Even a small drop in the rupee pushes up the landed cost of petrol and diesel. Prices may not immediately rise if oil companies absorb the shock, but pressure builds. Imported LPG becomes costlier, risking higher cylinder prices in the coming weeks.

Foreign education & travel: Indian students paying tuition fees in the US will see sharper bills, as each dollar now costs more. Foreign travel, especially to the US, becomes increasingly expensive with the depreciating value of the rupee.

Electronics & smartphones: Most components are imported. Retailers typically adjust prices with a lag, but consumers should expect costlier gadgets if the rupee stays weaker.

Economists warn that if the rupee remains above ₹90 for long, it could feed into overall inflation, which had recently begun cooling.

Impact on businesses and markets

The currency breach comes amid sustained foreign investor outflows, a widened trade deficit, and uncertainty over India–US trade talks, all of which have increased demand for dollars in the market.

Import-heavy industries such as aviation, automobiles, electronics, and pharmaceuticals are likely to face higher input costs. Exporters in sectors like IT services, textiles, and pharma formulations may benefit from earning in dollars, though these gains could be limited if global demand weakens. Stock markets may remain volatile as foreign portfolio investors pull out funds in response to rising currency risk. Bond yields could also climb if investors begin demanding higher returns to offset the impact of a weakening rupee.

RBI’s stance on the dipping Rupee

The Reserve Bank of India has intervened intermittently to smooth volatility but appears to be allowing the rupee to adjust naturally to global and domestic pressures. Reuters reporting indicates central bank interventions have been used in measured, staggered steps and that the RBI’s short US dollar positions have widened.

That approach has costs: continuing intervention and the need to supply dollars to markets can weigh on reserves. Official buffers remain sizable. India’s gross foreign exchange reserves are at about $688.1 billion as of Nov. 21, but market watchers say sustained capital outflows and a widening trade deficit could erode the cushion if pressures persist.

What to watch next

Market participants will monitor three immediate variables:

- Any concrete progress in trade talks that could assuage export and investment concerns.

- Monthly trade and capital flow numbers that will show whether the widening trade gap and outflows are stabilising or worsening; and

- RBI’s willingness to step up intervention.

A visible shift in any of these could halt or reverse the rupee’s slide; absent that, analysts warn the currency could remain volatile.

To stay updated on the Indian economy and trade news, follow The World Times.